Ser how Adoption?

a smol catch 22 for platform developers

AmpliFi functions as both an affiliate & referral platform with total flexibility.

As an Affiliate platform:

Protocols offer commissions <<– AmpliFi –>> Affiliates send audience to protocols.

Catch22: If there are no protocols offering commissions then there will be no affiliates. If there are no affiliates there will be no protocols offering commissions.

As a referral platform:

Protocol users–> AmpliFi –>> Protocols–> AmpliFi –>>Protocol Users

There is a slight improvement here since referral programs are driven by existing users however protocols may also decide to setup their own referral programs (we can help with that too!). However for max reach referral & affiliate programs should run together (two sources of new users, more reach etc).

A Double head start

Solving the catch 22

Luckily CRE8R DAO has given us a head start on client & afiliiates.

We already worked with 70+ protocols & have 30 plus protocols at various stages of setting up AmpliFi campaigns!!

And hundreds of content creators are already in our network.

Each protocol added brings more affiliates to the platform from within protocol communities and affiliate/referral programs can “cross pollenate”.

But how will we grow further? How will we reach out to the millions of existing affiliate marketers currently using web2 affiliate platforms? How do we create strong incentives for rapid growth of our affiliate network?

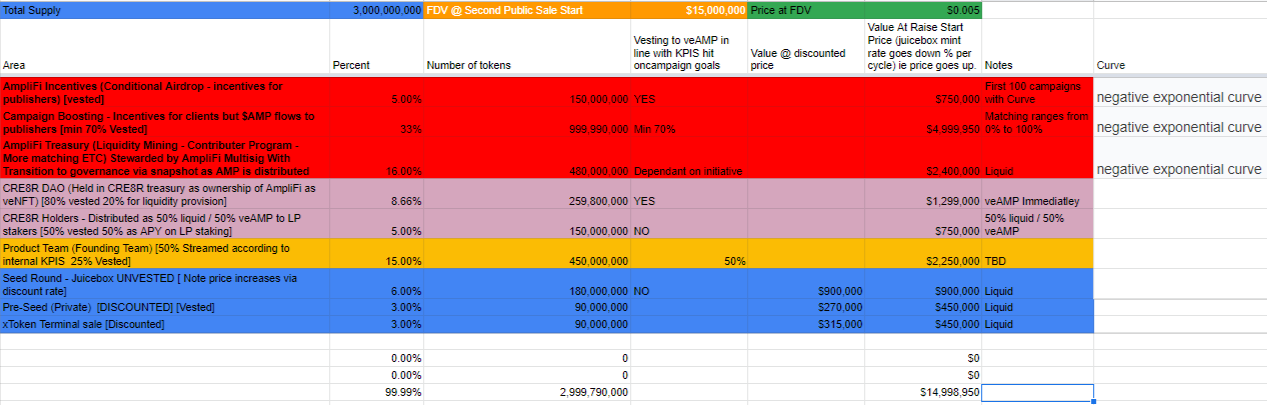

AmpliFi Tokenomics

A high level overview of AmpliFi tokenomics

$LAGG has 4 main purposes

- KPI based Reward token: Decentralising & accelerating adoption of the protocol via $LAGG (1 year Locked $AGG veCRV style) rapid initial distribution (as a larger % of affiliate earnings (~80% of revenue) tapering off to distribution in line with DAO earnings (~20% of revenue)

- Ecosystem token: Aligning incentives between stakeholders (Clients, Team, Contributors, Investors, Affiliates). Revenue flows proportionally to liquidity staking & $LAGG

- Governing Token: DAO processes – with ability to update revenue sharing parameters at program level & macro level.

- Real Revenue Token: Sharing the minimum 20% of revenue the DAO earns on each campaign/program to liquid staked $AGG LP token holders & $LAGG

The defining feature of AmpliFi tokenomics is distribution in line with the onchain KPIs defined for each campaign. Up to 59% of total $AGG is distributed as affiliates & the protocol earns. It's performance based. Measuring the bottom line metrics that protocols care about the most.

Lets walk through each area of our tokenomics and break it down. Note $AGG token is primarily distributed based on campaign metrics. This is mathmatically the most efficient token distribution method with zero waste or freeloaders. Each $AGG distributed is tied directly to AmpliFi protocol revenue. Which then flows to $LAGG lockers & liquid $AGG stakers.

AmpliFi Referral program (5% of total $AGG)

This is the affiliate program for AmpliFi itself. It empowers & incentivises affiliates to onboard more affiliates.

100% KPI based.

Refer a new affiliate and earn $LAGG in proportion to your referred affiliates earnings on campaigns.

Conditional Airdrop (5% of total $LAGG)

The provides a way to target key potential affiliates with a unique incentive based on key metrics such as follower count, website traffic, strategic partnership opportunities etc.

This “airdrop is still 100% KPI based. It is essentially a boost to $AGG earnings which are ALWAYS based on client program KPIS.

Campaign Boosting (33% of total $AGG)

The provides strong incentives for clients by matching $AGG alongside client incentives for referrers. This can be structured in two ways.

- Matching for each protocols campaign is settable as a percent of total campaign budget that will be paid out to referrers according to onchain KPIS.

This is most suitable for campaigns where the goal is primarily adoption and there is not significant revenue generated by the protocol at this time.For example prior to a protocol turning on a fee switch there may be no earnings to set a commission on. So a budget is set – AmpliFi can match this budget anywhere between 1:1 based on a DAO vote or team decision depending on phase.

- Matching in a range between referrer earnings & DAO earnings from a commission based campaign with $AGG. For example: If a protocol has a revenue generating mechanism such as trading fees, fundraising, interest on loans etc etc. AmpliFi DAO & affiliates may earn a % of this revenue.

- A mixture of options 1 & 2. For example matching $AGG on % commissions earned in stablecoins + 50% matching on governance tokens earned.

- Match a portion of the total campaign budget (usually paid in governance tokens) that will be paid out to referrers according to onchain KPIS with $LAGG

- Match a portion of commission on referred client protocol revenue or funds raised (usually paid in ETH/Stables) from a campaign with $LAGG

- A mix of both

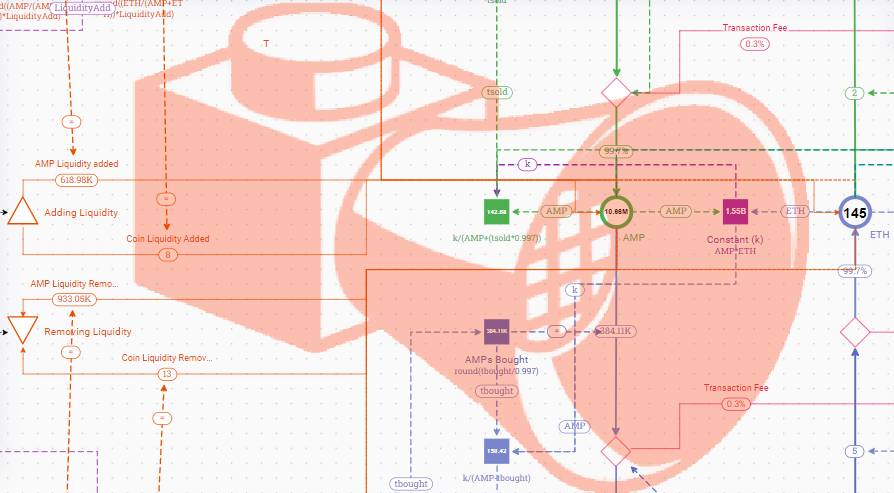

The Distribution Process for Affiliates via $LAGG

$LAGG becomes available based on each affiliates performance reflected directly by their earnings. By definition this means for $AGG to come into existence (via minting) there is revenue flowing to locked $AGG ($LAGG) and staked $AGG liquidity pool tokens.

TLDR

In the early stages affiliates will likely earn much more $LAGG per dollar earned than they will at later stages. This rightly lead many in the team & advisors to ask the question why buy the token during early stages of the protocol….

Wait, won't giving away half the supply To Affiliates cause massive sell pressure?

Balancing strong incentives for rapid adoption with sound tokenomics

Lets revisit the main purposes of $AGG again to explain..

- Decentralising & accelerating adoption of the protocol via $LAGG rapid initial distribution (as a larger % of affiliate earnings (~80% of revenue) tapering off to distribution in line with DAO earnings (~20% of revenue)

- Aligning incentives between stakeholders (Clients, Team, Contributors, Investors, Affiliates). Revenue flows proportionally to liquidity staking & $LAGG

- Governing DAO processes – with ability to update revenue sharing parameters at program level & macro level.

- Sharing the minimum 20% of revenue the DAO earns on each campaign/program.

40% of platform revenue after affiliate payouts flows to $LAGG in year one. 60% flows to liquid AGG/ETH stakers who have bought AGG.

This gives liquid AGG holders (investors/buyers of $AGG) 60% of revenue (after affiliate payouts) during the first year (from the time of first $LAGG locked). It also ensures zero sell pressure by affiliates during the first year from lock time. As $LAGG that does not go for further locking options (2-4 year locks which increase earnings) hits the market the platform will have had ~1.5 years to grow liquidity & revenue. Deep liquidity is ensured by sustainable real revenue staking APYs (no liquidity renting – only real revenue distribution).

AmpliFI team has produced some early modelling of these system dynamics which will be published prior to our first token . More details on that coming soon.

AmpliFly Wheel For Adoption by clients & affiliates

Matching $AGG

Matching $LAGG Provides huge incentives for protocols because it puts a multiplier on incentives for affiliates by giving ownership of platform revenue to $LAGG & liquid $AGG stakers ON TOP OF & in line with regular earnings.

This is comparable to a DEX offering liquidity mining rewards to a protocol for choosing the DEX or for moving their liquidity over from a competitor. The higher the rewards the more liquidity (or in our case the more affiliates driving onchain actions for protocols).

AmpliFi is subsidising the cost of onchain actions that drive protocol revenue for our clients (AmpliFi DAO & affiliates earn based on these metrics too).

The more affiliates producing onchain actions via marketing, the greater the success of the programs. The greater the success of the programs the more clients.

The more clients the more earnings for affiliates. The more earnings for affiliates the more affiliates. The more affiliates the more clients.

And the cycle continues…

AmpliFi meta referral program

Combine this with the AmpliFi referral program which brings in a constant source of new affiliates because existing affiliates are incentivised to bring in new affiliates.

Meta referral campaigns.

A secondary campaign for each protocol to ensure affiliate growth for each campaign is incentivised. Part of the matching $AGG budget can be used for this purpose.

Conditional Airdrop for high value publishers & strategic partners

Combine this with conditional airdrop targeting high value, strategic partners with custom incentives that are very hard to say no to. Plus a viral mechanism built in.

Sidenote: The functionality required to implement this feature is also available to individual campaigns – create lists of addresses or social accounts for targeting & then require wallet verification.

OK I Get The Flywheel For Adoption By Affiliates & Protocols

but what about token price? Number go up? Why should I buy $AGG?

Firstly a smol disclaimer: $AGG is designed to be a revenue sharing token when staked or locked it will earn platform revenue for as long as there is platform revenue. Affiliates only get $LAGG based on campaign earnings so as long as there are campaign earnings $AGG staked & locked with be earning revenue. However early buyers of $AGG will be speculating on future platform revenue since the platform is brand new. We do have an amazing list of DeFi protocols, web3 apps, NFT projects, GameFi & GambleFi projects in various stages of setting up AmpliFi campaigns. And we do have a solid and growing list of affiliates & publishers excited to promote these campaigns. But there is no guarantee that they will be successful.

In the vacuum of a single program

At 1:1 matching $AGG on DAO earnings (~20% of total protocol revenue) there will be ~$1 of stablecoins/ETH available for revenue sharing to $AGG (staked & $LAGG) for every dollar the DAO earns.

At 1:1 matching on affiliate earnings (~80% of total protocol revenue) there will be ~$0.2 dollars of revenue flowing to every dollar of matched $AGG

The reality will be somewhere in between due to the following factors.

- Initial AGG matching varies on a campaign by campaign basis

- AGG matching tapers off from initial higher matching over time in line with campaign adoption. For example a new protocols campaign may be added to AmpliFi with $.75 $AGG/$1 earned on the first 100k earned & .65 $AGG/$1 earned on the following 100k earned (this happens via curve maths).

- $LAGG matching tapers off from initial higher matching over time in line with general protocol adoption.

OK disclaimer over loading ampinvestooorshill.exe

There are two major factors we see as critical to the success of the AmpliFi platform & AmpliFi DAO more broadly.

- Affiliate & client adoption – covered extensively above

- Funding the team & contributors building the platform & researching the intersection of web2/web3 marketing tech

Lets talk about funding the team & contributors!

AmpliFi is not a fork. And we don’t have predecessors. The UX/UI & underlaying tech stack on the frontend, SDK and contract levels are all new. We are only just beginning to see affiliate/referral programs like GMX (who we are very excited to be partnering with by building on top of their existing referral program!!) taking off.

This is a whole new design space & AmpliFi DAOs mission is to innovate & improve what affiliate marketing means in the context of web3.

We are working with protocols to setup custom tracking systems for attribution of onchain events to marketing efforts + custom systems for handling trustless automated instant affiliate payments for each referral affiliate program we launch.

Our small team is heavy on business development, sales and dedicated devs designing setting up demo campaigns & working through the process of pushing them live.

Alongside continuing development of our platform, amplifi.js & AmpliFi SDK as well as smart contract wrappers that give us the option for 100% trustless instant payouts to affiliates/DAO for any onchain event.

Our team is currently self funded alongside a $175,000 investment from CRE8R DAO.

We have taken no other seed investment, no VCs and will proceed directly to a series of public sales.

The first public sale will launch on xToken Terminal’s Origination Platform as their first public sale!